Take home income calculator

Just select your province enter your gross salary choose at what frequency youre. Here are the steps to be followed to use the same.

Income Percentile Calculator For The United States

Take-Home Pay in the US Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income.

. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Actual rent paid minus 10 of the basic salary. See where that hard-earned money goes - with Federal Income Tax Social Security and other.

You know your salary. Fisdoms take-home salary calculator is simple and quick to use. STATucator - Filing Status.

Arkansas Income Tax Calculator 2021. EITCucator - Earned Income Tax Credit. The tax year 2022 will starts on Oct 01.

Enter Your Details Select 202223 in Tax Year and the calculator will show you what impact this has on your monthly take home pay and how. Your average tax rate is. Salary and pay calculator See how much youll be paid weekly fortnightly or monthly by entering a figure below Your pay Time period Annually Tax year 2022 - 2023 Superannuation Pay.

Choose the preferred tax regime old or new Select whether living. Income means money received for. Total annual income Adjustments Adjusted gross income.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Youll then get a breakdown of your total tax liability and take. 50 of the basic salary if staying in a metro city and 40 in a non-metro city.

When you make a pre-tax contribution to your. Why use this calculator. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

PENALTYucator - Late Filing Payment Penalties. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Your average tax rate is 1121 and your marginal.

Calculate Income tax by applying. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The second step is to figure out your adjusted gross income.

You can figure out your take-home salary in just a few clicks using our Canadian salary calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. That means that your net pay will be 37957 per year or 3163 per month.

How to use the Take-Home Calculator To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month. Income Tax Calculator How much tax will I pay. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

What will my take-home pay be. If you make 65000 a year living in the region of Arkansas USA you will be taxed 10992. It can also be used to help fill steps 3.

You can figure out your take-home salary in just a few clicks using our Canadian salary calculator. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. But how much are you really.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. To figure out your after-tax income enter your gross pay and additional details. That means that your net pay will be 40568 per year or 3381 per month.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Youll then get a breakdown of your total. Calculate Income tax by applying.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Net Profit Margin Formula And Ratio Calculator

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

How To Calculate Net Pay Step By Step Example

Salary Formula Calculate Salary Calculator Excel Template

Paycheck Calculator Take Home Pay Calculator

Salary Formula Calculate Salary Calculator Excel Template

53 Free Net Income Calculator Accounting Collection Accounting Bookkeeping Business Accounting Basics

Net Profit Margin Calculator Bdc Ca

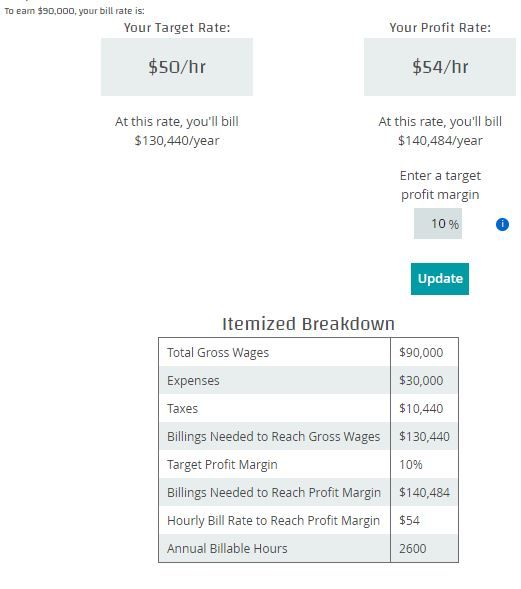

Hourly Rate Calculator Plan Projections Rate Calculator Saving Money

Excel Formula Income Tax Bracket Calculation Exceljet

Net To Gross Calculator

Salary Formula Calculate Salary Calculator Excel Template

Net Worth Calculator Find Your Net Worth Nerdwallet

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Gross Vs Net Income Key Differences How To Calculate Mbo Partners